A guide to building a B2B SaaS brand strategy that's more than a logo

A B2B SaaS brand is so much more than just a logo, it’s an identity that breathes character into your business. Learn the key strategies for how to...

Stijn Hendrikse

Having a SaaS marketing strategy is great.

But to establish your B2B SaaS company's marketing plan and marketing spend, you also need an accurate B2B SaaS marketing budget that will drive approved funding into your marketing efforts.

This is typically owned by your SaaS chief marketing officer and will empower your software company to achieve a set amount of outcomes at the right cost.

In the first week of most engagements I do with SaaS company CEOs, the inevitable question comes up: What should we budget for marketing? How do I get my first B2B SaaS marketing budget?

There are several guidelines that people usually fall back on, ranging from the percentage of annual recurring revenue to one-time, fixed budgets for some of the fundamentals (like getting a website in place). Every situation is different. So how to approach the budget question? (TLDR: Jump to the formula right away here.)

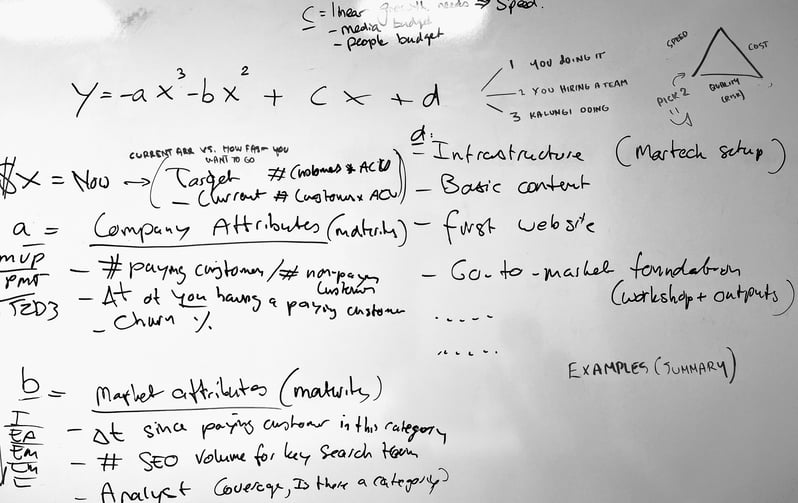

After a couple of brainstorms around this whiteboard, we came up with an alternative to the typical rule of thumb using % of revenue.

In the second part of this article, we go into some algebra, but I promise math camp will only be a quick overview before we make it concrete again.

Let’s start with some fundamental best practices before we jump into a specific budget calculation:

Marketing is not a one-time initiative. You need to build a foundation for lasting growth and build ongoing engines on top of this. When you launch a new website, make sure you can keep it fresh and provide a great experience and service to the visitors. Don’t launch an event, a blog, or a series of webinars unless you can keep them going at whatever pace is sustainable for you.

Don’t spend money unless you can manage the things you spend it on. For example, don’t spend money on paid search advertising if you can’t afford someone with the right expertise who can manage this spending with the right focus, and hold either the agency or internal team accountable. Don’t start spending on tactics that you can’t measure or benchmark.

Don’t sacrifice quality just to be able to do more. As a fast-growing startup, you want to look bigger than you really are. This starts with credibility, consistency, and predictability.

For example, your team shouldn’t start with paid advertising or content marketing unless you have a solid infrastructure to nurture and follow up with prospects as they start hitting your site. Don’t run campaigns unless you can do A/B tests. Don’t promote content that’s not good enough to drive engagement from your audience. Don’t hire young, high-energy marketing team members unless you know what they should be working on, and you can provide the right coaching.

Some budget guidelines that use a percentage of revenue have broad ranges (some say 6% to 20% of ARR). That’s usually because some startups have a mandate to do a “land grab” and capture market share fast (and that’s why they got a big Series A funding check). Other startups are expected to get to profitability as soon as possible. This will drive your marketing budget percentage allocation as either a well-funded b2b SaaS company or a bootstrapped success story that wants to stay profitable.

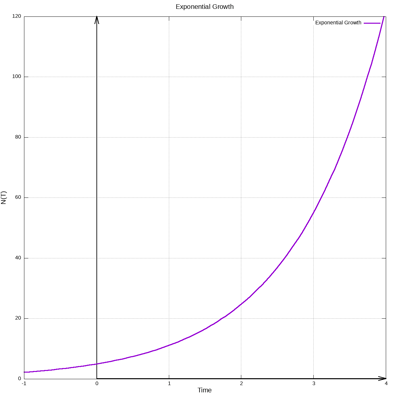

While most startup leaders sell their investors on a j-curve exponential growth model, the reality is that this is a mathematically impossible growth trajectory. In exponential growth, the amount of revenue growth, or new customers added, per invested dollar (aka ROMI, Return on Marketing Investment) stays growing with the same acceleration regardless of your total revenue, market size, or spend level, making you grow faster and faster as your budget and resources grow.

In theory, a SaaS company could take over the world just by buying more market share (aka leads) and making sure conversion rates to paying customers, and their retention rate, don’t drop.

For instance, imagine you can buy a high-quality lead on a marketplace like Software Advice for $500. Let's say these leads have proven to predictably convert at a 10% rate into paying customers who fit your ICP.

Assuming a decent annual churn rate at 8.3%, a paying client stays for about 10 years. Accounting for a 10% cost to service this client, and an annual ARPU expansion of 5%, your return on the initial investment of $500 would be a whopping 15243%.

| Year | Cost/lead | ARPU | Cost to Service | LTV |

| 1 | -$500 | -$500 | ||

| 2 | $6,000 | -$600 | $4,900 | |

| 3 | $6,300 | -$630 | $10,570 | |

| 4 | $6,615 | -$662 | $16,524 | |

| 5 | $6,946 | -$695 | $22,775 | |

| 6 | $7,293 | -$729 | $29338 | |

| 7 | $7,658 | -$766 | $36,230 | |

| 8 | $8,041 | -$804 | $43,467 | |

| 9 | $8,443 | -$844 | $51,065 | |

| 10 | $8,865 | -$886 | $59,043 | |

| 11 | $9,308 | -$931 | $67,421 | |

| 12 | $9,773 | -$977 | $76,217 |

While the numbers in the above table, driven by the fundamental effect of SaaS growth drivers, is the main reason B2B SaaS businesses are such a great investment, applying the above exponential growth curve as a foundation for our growth budget is fundamentally flawed.

The assumption of an unlimited number of high-quality leads, available customers, and sustainable churn and ARPU expansion levels is just not possible.

In nature, populations may grow exponentially for some period and then become limited by resource availability.

Your B2B SaaS marketing investments also must account for the limited available inventory of paid search clicks, advertising real estate, prospect attention span, and ultimately the number of customers who need what you have.

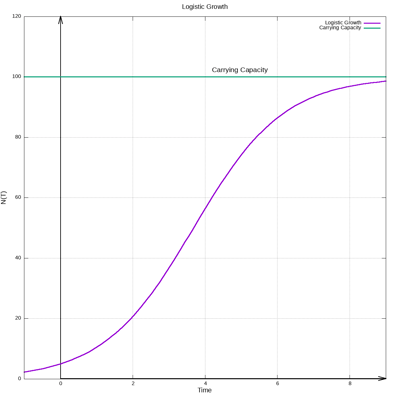

To get a more realistic understanding of our potential growth path and the required investments, we need to apply a so-called logistic growth model. The logistic growth model of your SaaS company pertains to the growth per invested capital unit, which gets smaller and smaller as demand generation channels approach a maximum imposed by the limits of your target market. This is also known as the carrying capacity (for example, the number of customers available in a given market).

For software businesses, your carrying capacity is also impacted by forces like competitors copying your solution, or government and regulatory bodies only allowing a certain level of market dominance by one provider.

Exponential growth produces a J-shaped curve, while logistic growth produces an S-shaped curve:

We can mathematically model logistic growth by modifying the equation for exponential growth, limiting a growth rate r (growth rate per invested unit of capital and resources) that depends on market share (N) and how close it is to carrying capacity, or market saturation (K).

If a SaaS company has a base growth rate of rmax when it’s still small, we can write this as follows (K and N representing for example number of customers):

.gif?width=630&name=CodeCogsEqn%20(3).gif)

Let's take a minute to dissect this equation and see why it makes sense.

The solution for this differential equation is N(T).

.gif?width=630&name=CodeCogsEqn%20(4).gif)

This fits with our graph above (Logistic Growth): Market share grows near-exponentially at first, but levels off more and more as it approaches K.

If you're looking to get a better idea of your potential market's size, conduct a TAM, SAM, SOM analysis that will allow you to analyze the size of your total market as well as that of the smaller, specified market you'll approach first.

Regardless of fancy formulas, what does this really mean? Most B2B SaaS ventures find themselves on the left side of this spectrum, in relatively underdeveloped market segments (and if you'd like to learn more about how that should impact your go-to-market strategy, see this blog). So why worry about potentially slower growth rates in the distant future?

While it’s true that most of you by definition will pick a high-growth segment of the market to focus on and thus will be living in the land of exponential SaaS growth for a while, you are also “banking” a lot of your planning and investment decisions on the long term value of your clients.

For example, you might be convinced that you can afford a relatively high Customer Acquisition Cost (CAC) because of your exponential growth forecast and the impact on the Customer Lifetime Value (CLV) and its impact or your ability to afford a higher CAC.

Given this long-term investment thesis for your growth capital, it’s important to understand what the limitations of growing in your target market are, and when you need to adjust your approach. All this is critical to have a holistic budget plan to support the right investments today that support your company's growth potential over time.

Many SaaS CEOs have oversold the value of their growth plan as they did not account for the reality that the market they service will get saturated at some point, driven by increased downward pressure on pricing, increased customer churn as some customers leave to competitors, and a predictable slow down of demand generation as your market share grows.

Your ability to accelerate market growth by spending more will eventually realize diminishing returns.

As a growing SaaS Start-up first or early to a fast-developing new market category, it's important your sales and marketing teams grab. What is the right ROI trade-off to satisfy your investor's comfort level with a land grab of your target market segment vs. a reduction in ROI?

Resources needed to fuel SaaS growth can become a limiting factor. Internal factors include:

On the other hand, external factors include:

Let’s look at how you can use all these factors and the limited information you have for them, to budget your growth as accurately as possible.

When you type into a google search bar “how much to spend on marketing,” you’ll get a long list of search results that cover the following general themes:

As you can see, these numbers are all over the place. They don’t really help create an actual budget to support your plan since they don't take into account many critical factors. The biggest missing dimension is the maturity of the market you are in, as discussed in the earlier speed vs. ROI topic.

Startups need to invest in marketing until the desired market share is established and can be sustained. During this phase, you will build up your own brand, and you may need to educate the market if your category is still young. Therefore, a typical startup budgets at least 20% of revenue for marketing efforts and sometimes more.

Let’s first define what’s in your SaaS ‘marketing budget.’

Consider including all the costs for marketing, advertising, public relations, promotions, and any other strategic or tactical investments like Google Ads, social media, print advertising, sponsorships, sales collateral, user groups, in-person events, and sometimes even sales discounts disguised as promotions.

I also like to include people's costs, since early-stage marketing efforts will be more dependent on the work you can do, than the media you can buy.

The following are the basic inputs I like to use when recommending a budget for the marketing plan:

The above inputs will have different levels of impact on the budget needed to reach the desired growth volume, at the expected speed. I've found it helpful to express the budget needed as a function of the various inputs with a formula that allows us to account for the level of impact of each input. So let y(x) be the budget function:

.gif?width=662&name=CodeCogsEqn%20(6).gif)

The outcome “y” is a proxy for your needed budget and will go up or down based on the following terms and their factors. Let's explore these individual variables in the context of your SaaS marketing budget.

Calculating any marketing budget starts with establishing how much you want to grow. This x-factor is based on subtracting your current ARR, from the target ARR. You can use any combination of net new customer accounts multiplied by their ACV or net new ARR growth. You need a financial growth target based on these assumptions.

Next, the coefficients that make up the terms of the right side of the formula represent various inputs with different levels of impact, in order of high to lowest impact:

These inputs have the largest impact. Most of these are about the maturity of your product or company vs. the market you are in. The larger this number, the less budget you need.

These are inputs that describe the maturity of the market you are targeting.

While in a very immature market, you will need more budget to help “make the market” and educate your audience, these inputs will have the reverse effect once a market gets established and your competition increases. A market that gets more crowded will be costlier to target, thus this number b will drive up your budget needs exponentially as it goes up. Example inputs are:

As it's not easy to calculate these, our team led by Mike Northfield and Brian Graf has created a great spreadsheet model to help you with this.

The speed at which you will realize your growth or the time it will take you to achieve the desired outcomes typically has a linear impact on the investment needed. Short of strange economical anomalies like hyperinflation, you should be able to double your speed by doubling your budget in most of the areas that you control through your marketing investment. You can assume this as a linear relationship between budget and growth since you are already accounting for the non-linear a, b, and d coefficients in this model.

Finally, there is a fixed cost to get on the field when it comes to marketing. You need to build a certain foundation, regardless of the amount of growth, or speed that you desire. Here are some examples that will have a fixed budget impact:

To go from theory to providing you with a simple way to calculate your investment needs, Mike Northfield and Brian Graf at Kalungi have updated multiple budget templates with data from many existing successful SaaS companies based on these updated calculations.

Set up a time to speak with one of our CMOs to use these to complement your marketing planning.

Finally, no budget conversation would be complete without addressing the topic of “product-led growth.”

While the integration of product management and engineering, with marketing techniques to drive growth is nothing new, the recent success of so-called product growth-led SaaS Marketing firms has brought new focus to this. Product-led growth is not really different from what used to be called growth hacking, sometimes combined with network effects (products like hotmail.com and Microsoft Office with its document formats grew with product-led growth a long time ago).

Some people advocate moving the budget from pure demand generation (marketing and sales) to R&D to benefit from the higher value fly-wheel effects that a product-led growth approach yields. I don’t think this is an either-or decision.

I strongly advocate for every marketing leader, and their team, in a software company, to work closely with the engineering team and product leaders to integrate nurture, content marketing, promotions, and driving customer engagement into the product, and treating it as another, very valuable, and highly controlled marketing channel with a captive audience (your users and customers).

Here are a couple more links to explore on the topic of creating your B2B SaaS Marketing budget:

A B2B SaaS brand is so much more than just a logo, it’s an identity that breathes character into your business. Learn the key strategies for how to...

Discover how to buy a quality B2B marketing list: why it's crucial, finding a good provider, and tips before you purchase one.

Building your ideal customer profile (ICP) improves your B2B business accuracy. Learn how with our free downloadable template.