The Opportunity Cost of In-Housing: Why Strong SaaS Teams Still Outsource Critical Work

Discover why outsourcing can enhance focus and leverage for scaling SaaS companies, preserving leadership attention and driving strategic growth.

Luis Aguiar

When it comes to understanding your customers’ value and the cost of acquiring them, two metrics stand out: Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC). These metrics are essential for calculating the LTV to CAC ratio, a vital benchmark for SaaS companies.

Before diving into the ratio, you first need to know how to calculate LTV and CAC.

In this guide, we’ll break down both metrics, explain their importance, and walk you through how to use the LTV to CAC ratio to make data-driven decisions for your SaaS business.

In marketing, Customer Lifetime Value or Lifetime Value is an estimate of the net profit contributed to the future relationship with a customer. In other words, it is the average revenue that a customer will generate throughout their lifespan as a customer. This metric is important because it represents an upper limit on spending to acquire new customers.

The purpose of the CLV is to assess the financial value of each customer. This metric differs from customer profitability in the latter measures the past, and CLV looks forward.

CLV can be more useful in shaping your marketing leadership decisions but is much more difficult to quantify. While quantifying CP is carefully reporting and summarizing past activity results, quantifying CLV involves forecasting future activity.

There are many ways to calculate CLV. Depending on your business needs and conditions, the CLV formula can be as complex as you want it to be.

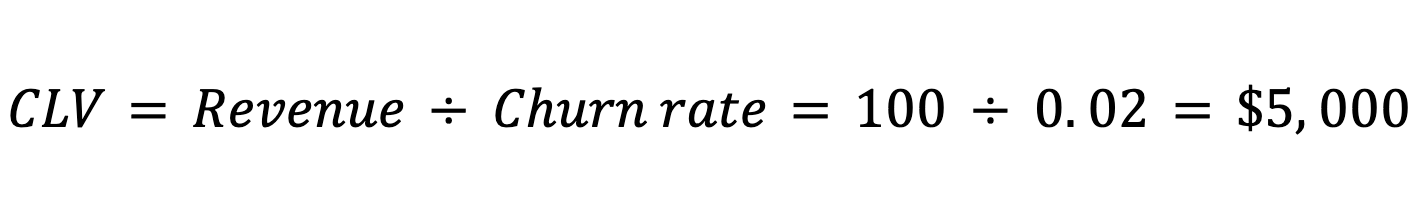

Let’s take two examples: If we assume the yearly discount rate is 0% (more on this later), we can calculate a simple CLV model. If you charge on average $100/month per customer, and your churn rate, in the same period, is 2%, then your CLV formula is as follows:

In this case, your CLV is equal to $5,000 or 50 months.

Now, let’s see example number two.

In this one, we assume a discount rate different than 0%; this is also known as the cost of capital, a variable present in all calculations of the time value of money.

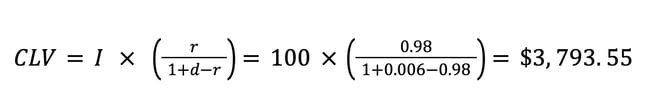

That being said, if we assume a yearly discount rate of 7% and we keep the rest as the last example, our formula would change to this new one:

First, we need to clarify the new variables: I is for revenue, r is for retention rate, and d is the discount rate. For the equation to make financial sense, we need to divide the yearly discount rate by twelve; that way, we get the monthly average we need to calculate the CLV in this particular example. Now the CLV is $3,793.55 or approximately 38 months.

There are different ways to take a reference as the yearly discount rate, it could be actual interest rates or the inflation rate, but it will depend on each case you work. We used a random number for the sake of this example.

Customer Acquisition Cost (CAC) is the marketing and sales cost associated with attracting a new customer to buy a product or service over a period of time. With CAC, companies can measure the money spent on acquiring new customers and help determine profitability. That’s why it is frequently combined with CLV.

To calculate your CAC, first, you need to establish the time period of study. This will help you gather the precise data you need.

With this information, you can know all the other sales and marketing costs that would go into calculating the CAC. These can include salaries, bonuses, commissions, creative costs, production costs, Ad expenditure, technical costs, inventory upkeep, and overhead associated with attracting leads and converting them into new customers.

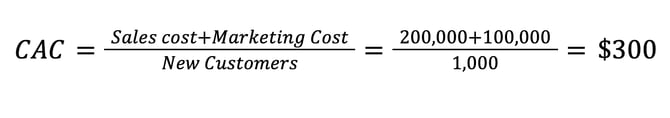

For example, suppose your company spends $100,000 on marketing, $200,000 on sales, and generates 1,000 customers over a year. In that case, you can calculate the value of your CAC following the next formula:

Companies are always looking to reduce their CAC not just to obtain higher profitability margins but because they want to optimize as much as possible their marketing, sales, and customer service efforts.

Spending less money while generating the same or even more customers means you’re using your budget more efficiently, which translates into positive signs from your marketing and sales teams' performance.

So if you’re looking to reduce your Customer Acquisition Cost, take a look at the variables you’re using and find ways to optimize them.

As said in the section before, CAC tends to be studied in pairs with CLV. This is because you’re comparing how much you are spending to get a new customer against the revenue you’re getting from it.

It compares the revenue a customer generates over their lifetime (Customer Lifetime Value or CLV) to the cost of acquiring that customer (Customer Acquisition Cost or CAC).

This ratio helps you understand whether your marketing and sales investments are yielding sustainable growth.

For example:

By calculating and monitoring the CLV to CAC ratio, SaaS founders and executives can make data-driven decisions about resource allocation, optimize customer acquisition strategies, and ensure long-term success.

Tracking SaaS metrics like the CAC:LTV ratio is essential for making informed decisions about your business's growth and profitability. These metrics provide a clear view of how effectively you're acquiring and retaining customers—and whether your efforts are financially sustainable.

Here’s why the CAC:LTV ratio matters:

Successful SaaS businesses rely on key metrics like customer acquisition cost (CAC) and customer lifetime value (LTV). These SaaS metrics help you track progress and make informed decisions.

To truly optimize these metrics, you need a cohesive marketing strategy.

Kalungi is a full-service B2B SaaS marketing agency that specializes in helping companies like yours achieve sustainable growth. We work closely with our clients to develop and implement effective go-to-market strategies, covering everything from positioning and messaging to demand generation.

Our team of experienced SaaS CMOs and our proven T2D3 playbook have helped over 100 SaaS companies increase their MRR and grow.

Ready to discuss your SaaS growth goals? Schedule a discovery call with Kalungi today and learn how we can help your business.

Discover why outsourcing can enhance focus and leverage for scaling SaaS companies, preserving leadership attention and driving strategic growth.

Discover how B2B SaaS companies can reverse rising customer acquisition costs by adopting a more efficient, lifecycle-focused marketing strategy. ===...

When it comes to email marketing, various factors can affect your email deliverability. Learn how to keep your email campaigns out of the spam folder.