If someone were to ask you today what your company’s SaaS churn rate is, could you answer?

Knowing churn will give you helpful insights into your SaaS product or services. In addition, it will help you calculate your company’s market value, understand your superpowers, and identify where you lose to competitors.

And once you understand your churn, you can develop a strategy to lower your rate and improve customer retention.

The importance of measuring churn for SaaS companies

In the ever-changing world of SaaS, it’s especially important to know how many customers you are losing. And if you didn’t know, venture capitalists (VCs) look at churn when deciding whether or not to back companies—which makes it a crucial metric to monitor.

In addition to increasing your SaaS company’s value, knowing your churn rate can also:

- Give you visibility into customer experience

- Paint a big-picture view of your growth

- Show your superpowers (or weaknesses)

- Provide data and insights to reduce churn and increase retention

So the next question is: what are the best SaaS churn formulas to get started?

Four formulas to help you measure your customer churn rate

Below is a list of four SaaS churn formulas you can easily follow to help you gain visibility into your customer base:

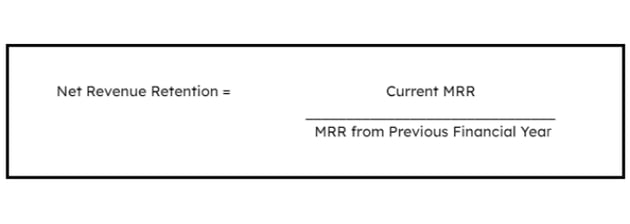

1. Net revenue retention (NRR)

Net revenue retention measures the total change in recurring revenue from a pool of customers over time. NRR is one of the most comprehensive metrics to measure churn. It tells a complete story: both the positive impact of price changes and the negative impact of lost customers.

You will need the following numbers to calculate your net revenue retention:

- Your company’s monthly recurring revenue (MRR) from the previous financial year

- Your company’s current MRR pulled from the same group of customers

Retention is an important number to know. Customer acquisition cost (CAC) in the SaaS world is expensive—to gain $1 in annual recurring revenue (ARR) per customer, the average cost is $1.32. Maintaining your existing customers costs less—down to $0.71 per customer.

Retention is an important number to know. Customer acquisition cost (CAC) in the SaaS world is expensive—to gain $1 in annual recurring revenue (ARR) per customer, the average cost is $1.32. Maintaining your existing customers costs less—down to $0.71 per customer.

The higher your NRR, the more likely it is that your business provides valuable offerings to your customers. Established companies consider 125% a good number, and startup SaaS companies see rates even higher than that.

Once you know your NRR, you can evaluate if you’re happy with your number or if you need to start implementing new strategies to entice your customers to stick around.

2. Monthly churn

This metric refers to the percentage of customers your company has lost after a month and provides a more immediate indication of your company’s overall churn. Keep in mind if your business is growing quickly, monthly churn will not accurately reflect your overall churn.

This metric is also a fairly volatile number. If you choose to use this metric for immediate results, make sure you take this number with a grain of salt.

To calculate monthly churn, you need to know the following:

- Last month’s lost MRR

- Last month’s total MRR

.webp?width=630&height=224&name=Monthly%20Churn%20SaaS%20metrics%20(1).webp) In B2B SaaS, you want to aim for a monthly churn rate of about less than 2%. If you keep getting a high number, it’s time to strategize ways to reduce monthly churn. Start by asking for feedback from your existing customers. Then, scrutinize every touchpoint—from onboarding to solution implementation. How can you make things better for your user?

In B2B SaaS, you want to aim for a monthly churn rate of about less than 2%. If you keep getting a high number, it’s time to strategize ways to reduce monthly churn. Start by asking for feedback from your existing customers. Then, scrutinize every touchpoint—from onboarding to solution implementation. How can you make things better for your user?

And don’t forget—even if you have a high monthly churn, evaluate other aspects of your company (such as sudden growth) before taking action.

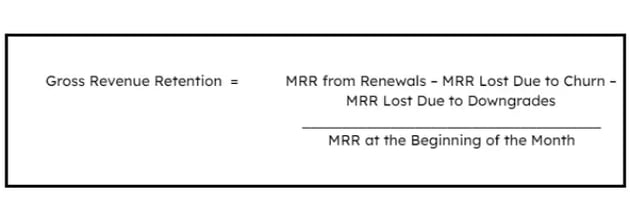

3. Gross revenue retention (GRR)

Gross revenue retention measures annual revenue lost from your customer base. GRR indicates how your company is really doing over time when it comes to retaining revenue from your customers. This metric will always be equal to or lower than your net revenue retention.

To calculate gross revenue retention, you need to know the following:

- MRR from renewals

- MRR lost due to churn

- MRR lost due to downgrades

- MRR at the beginning of the month

However, keep in mind that the MRR for each current individual customer cannot exceed the MRR for that same customer last year.

While GRR will always be less than 100%, a good rule of thumb is to have the ratio closer to 100 than 0. The lower your GRR, the less likely VCs are to invest in your business because it indicates that your business isn’t viable in the long run.

While GRR will always be less than 100%, a good rule of thumb is to have the ratio closer to 100 than 0. The lower your GRR, the less likely VCs are to invest in your business because it indicates that your business isn’t viable in the long run.

If you have a low GRR, it’s time to take a serious look at customer retention and work to lower your churn.

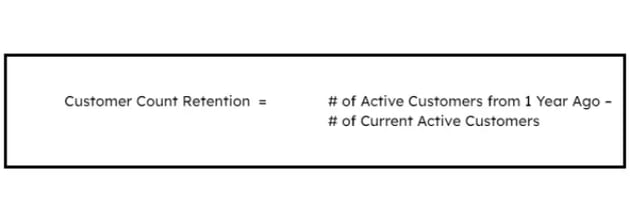

4. Customer count retention (CCR)

This metric is often used in conjunction with net revenue retention. It’s based on the count of active customers from one year ago—and how many of those customers are still active today.

Customer count retention treats all customers as financial equals, which tends to overstate the impact of churn.

In order to calculate customer count retention, you will need to know the following information:

- The number of active customers your company had one year ago

- The number of current active customers

You want a high CCR rate. This metric is useful because it takes a step back from a purely financial standpoint and adds color to the picture. You can more easily grasp weaknesses in your customer retention strategy that metrics such as NRR or GRR overlook.

You want a high CCR rate. This metric is useful because it takes a step back from a purely financial standpoint and adds color to the picture. You can more easily grasp weaknesses in your customer retention strategy that metrics such as NRR or GRR overlook.

Finding the SaaS churn formula reporting that works for you

Remember: these formulas are here to help you get an idea of how churn impacts your company. SaaS, in particular, is constantly changing—so don’t just choose one calculation and settle for it. If you want to get more granular, continue researching alternate formulas to measure churn. Here are some helpful steps to determine which SaaS metrics work for you:

- Do more than one calculation to gain a clear picture of your churn

- Research additional metrics for your reporting, such as company size and customer base (if you’re targeting Startups, you’ll have a higher churn rate. Enterprise customers are less likely to churn).

- Look at your churn metrics together to identify strengths and weaknesses

- Be proactive and identify customers who are at risk of churning

- Measure consistently to get a company benchmark for churn

- Find out your industry’s specific churn benchmarks

- Use industry and personal benchmarks to help strategize churn reduction and increase customer retention

Evaluate what’s working—and what’s not. Take advantage of the lower CAC associated with retaining customers and use these SaaS churn metrics to your advantage. Identify your superpowers and strengthen their impact.

Knowing your SaaS churn rate and applying strategies to reduce it could be the difference between VC funding or not, so don’t skip out on this important information.